Thousands of baby boomers are living with intergenerational housemates. Say hello to “boommates.”

By Michael J. Coren | The Washington Post (abridged)

Intergenerational living was once common in American cities. Everyone from families of modest means to the upper-class rented out rooms or entire floors. These boardinghouses served as many as half of 19th-century urban residents.

Poet Walt Whitman, who lived in boardinghouses in his early teens, described them as the country’s melting pot in 1842. “Married men and single men, old men and pretty girls; milliners and masons; cobblers, colonels, and counter-jumpers; tailors and teachers; lieutenants, loafers, ladies, lackbrains, and lawyers; printers and parsons—‘black spirits and white, blue spirits and gay’—all ‘go out to board,’” reports the Boston Globe.

Yet many cities have essentially outlawed new duplexes and townhouses built to accommodate multiple generations under one roof. Exclusionary zoning laws restrict 70 percent of all residential land to single-family homes fueling a dire affordability crisis, according to a 2024 report by the White House Council of Economic Advisers.

Last year, three-quarters of the country’s housing markets were considered unaffordable, according to Attom, a real estate data company. Homeowners are spending about 35 percent of their income on housing costs on average, far above the 28 percent benchmark to be considered affordable.

Bigger homes also are scarce because empty nesters are still in them, says Jennifer Molinsky of Harvard University’s Joint Center for Housing Studies. Baby-boomer households without children living at home own an estimated 28 percent of the nation’s large houses with three or more bedrooms compared with just 14 percent of millennial households with children, despite this generation outnumbering its boomer counterparts.

There are good reasons baby boomers are holding on to their houses: Older homeowners typically enjoy rock-bottom mortgage rates, and the vast majority prefer to grow old in their own homes. Even for those willing to move, few options to downsize exist because of the scarcity of affordable, “missing-middle” housing units in their communities.

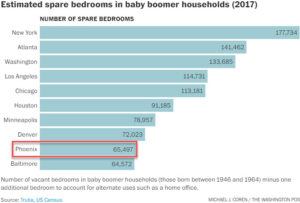

That means millions of bedrooms sit empty. The real estate company Trulia estimated in 2017 that 3.6 million vacant bedrooms in baby-boomer households could be rented out in the 100 largest U.S. metro areas.

The rise of the boommate

The housing crunch prompted Nancy, a retired professor of astronomy who lives in a Boston suburb, to open up her 1889, five-bedroom house to renters.

“I started renting in 2016, and never looked back,” she says, asking her last name not be used for privacy. “Even if I had plenty of money, I don’t think I would want to live here by myself.”

Typically, she has an older housemate and a younger one, a graduate student from nearby Boston College placed by the school’s housing office. Each person has their own bedroom and private bathroom, and the trio share a kitchen and common space, occasional meals or even road trips. “All have been great people,” she adds.

Like Nancy, some over the age of 65 now live with unrelated housemates or roommates, according to estimates based on 2022 U.S. census data by Molinsky. About 50 percent of them are younger adults.

There are now a variety of services that help people find a boommate. HomeShare Online (formerly Silvernest) offers nationwide matching with free and paid tiers. Nesterly finds graduate students in college towns willing to help with household chores for discounted rent. An online search will probably turn up a home-sharing agency near you, often at no cost. The National Shared Housing Resource Center lists about 50 nonprofits.

For those who can afford it, carving a duplex, private suite or accessory dwelling unit (ADU) out of an existing home can offer more privacy and revenue. Some companies even pay homeowners for this. California startup BuildCasa offers up to $400,000 to subdivide your lot, and build a backyard ADU or duplex it owns. If you want your own, BuildCasa can advise you on the process of creating a second property for them to rent or sell.

Read More (subscriber content)

Some stories may only appear as partial reprints because of publisher restrictions.

Related:

What’s Holding Housing Back? – Pt. 1: Advocacy & Workforce Housing

What’s Holding Housing Back? – Pt. 2: Missing Middle